Running a law practice without a financial plan is like arguing a case without knowing the facts.

You may be skilled in the courtroom or confident in client strategy, but many lawyers and firms operate without a clear financial roadmap for managing money.

As a result, there is unstable cash flow, underused resources, and missed chances to grow.

Financial planning is not limited to balancing books or saving for taxes; it also ensures your practice runs efficiently today while staying secure and scalable for tomorrow.

Whether you’re a solo lawyer juggling every responsibility or managing a mid-sized firm with growing overhead, a strong financial plan gives you structure, clarity, and long-term control.

In this blog, you’ll learn why financial planning is often neglected in legal practice and how to manage money more effectively to improve economic stability and support long-term growth.

Common Financial Planning Challenges Lawyers Face

Here are some main reasons financial planning can be challenging for lawyers:

Irregular Income

Legal work often leads to unpredictable cash flow, especially in litigation, contingency-based cases, or solo practice. Client payments may be delayed, and large settlements can create spikes that distort planning.

Lack of Financial Training

Law school doesn’t teach personal finance, accounting, or business management, so you may not know how to budget, invest, or read financial statements.

High Operating Costs

Running a practice comes with recurring costs: salaries, rent, malpractice insurance, software, and marketing. Without a clear plan, these costs can quickly eat into your earnings.

Complex Tax Obligations

Your tax situation is more complicated as a high-earning professional or firm owner. Without planning, you may overpay or face underpayment penalties.

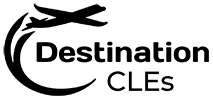

Components of Law Firm Financial Management

Effective financial management in a law firm involves several core components that help you control costs, track performance, and support long-term growth. Here are some of the essential components that you must keep in mind when planning your finances:

1. Budgeting

Creating a budget is the foundation of your firm’s financial health. It helps you plan for expenses, manage cash flow, and set revenue goals. Without a clear budget, measuring performance or making informed decisions is difficult.

Start by tracking your regular expenses, such as salaries, rent, and software, and then project your expected income. This will allow you to allocate resources effectively and avoid overspending.

2. Profit Analysis

Profitability analysis lets you assess which services or practice areas are generating profit. For law firms, this involves analyzing billable hours and utilization rates.

Realization rates also help show how much of your billed work is collected. These metrics reveal how efficient and profitable your operations are. Regular analysis lets you understand where to improve pricing, workload balance, or resource allocation.

3. Long-Term Financial Planning

Long-term planning helps you manage debts, plan for growth, and secure future revenue. It includes tracking long-term obligations like loans and extended cases. Anything expected to span over a year should be part of this plan. In contrast, short-term planning covers your day-to-day expenses and income.

4. Profit Center Accounting

If your firm operates in multiple practice areas, profit center accounting can help you track performance more accurately. Treating each practice area as a separate profit center allows you to analyze its revenue and expenses.

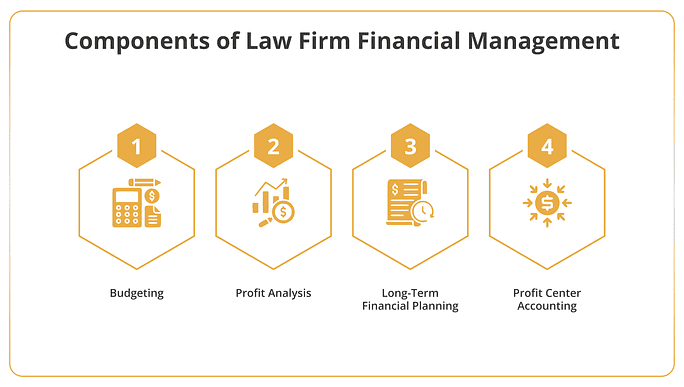

How can Lawyers and Law Firms Build a Sustainable Financial Plan?

A sustainable financial plan gives you control over your firm’s finances. It helps you manage costs, grow revenue, and prepare for future risks. Here’s how to build one:

-

Assess Your Current Financial Position

Start by gathering an accurate picture of your firm’s current financial state. Review your total revenue from all sources, including hourly billing, retainers, and other income streams. Track your monthly and annual expenses, both fixed and variable.

List all debts and liabilities, such as business loans or outstanding payments. Also, look at your available cash and any emergency savings. This information shows where you stand financially and helps guide your next steps.

-

Set Clear Financial Goals

Once you understand your financial position, set specific and realistic goals. Define both short-term and long-term objectives. For example, you could increase billable hours, reduce operational costs, build a cash reserve, or pay down debt.

For example, aim to boost billable hours by 10% this year or create a three-month emergency fund. Ensure your goals are measurable and aligned with your firm’s size, structure, and growth plans.

-

Create a Monthly and Annual Budget

Use your financial data to create a detailed monthly and annual budget. Include fixed costs like salaries, office rent, and insurance. Add variable costs such as marketing expenses, technology, and court-related fees.

Estimate your revenue based on past trends and expected caseload. Your budget should help you track progress, spot issues early, and adjust as needed. Compare your projected figures with actual results to stay on course.

-

Plan for Cash Flow Stability

A steady cash flow is essential to keeping your firm running. Plan for expected inflows and outflows over time. Consider seasonal revenue shifts, delayed client payments, and large upcoming expenses.

Identify periods where cash may be tight. To stay prepared, maintain a cash buffer or access to a line of credit. This helps you handle shortfalls without affecting daily operations.

-

Allocate for Taxes and Compliance

Make sure your financial plan includes taxes and compliance obligations. Set aside money throughout the year to cover estimated tax payments. Keep track of deadlines and work with a tax advisor who understands legal practices.

If you handle client trust accounts, follow all regulations closely. Proper tax planning helps you avoid penalties and makes year-end reporting smoother.

-

Invest in Growth and Risk Management

Consider how your firm can grow and what risks you need to cover. Plan financially for hiring staff, expanding your services, or upgrading technology. Include insurance needs such as malpractice, cyber liability, or general business coverage.

If you plan to retire or transition the firm, start preparing early. Make these part of your long-term strategy, not just one-time fixes.

-

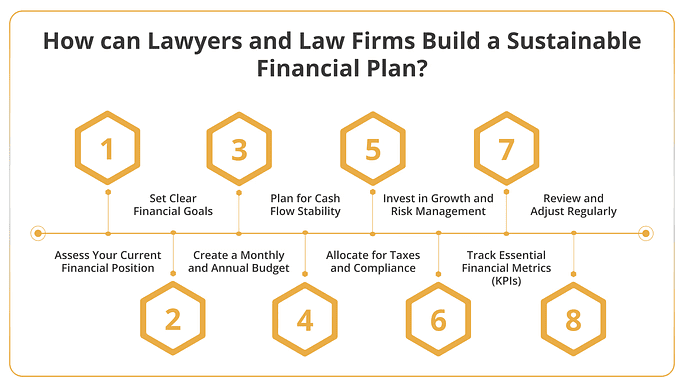

Track Essential Financial Metrics (KPIs)

Monitor essential financial metrics to measure your firm’s performance. Track your utilization rate to see how much of your time is billable. Watch your realization and collection rates to understand how much of your work becomes revenue.

Calculate your net profit margin to see what’s left after expenses. Other useful metrics include client acquisition cost and average case value. Review these regularly to make informed decisions and identify areas for improvement.

8. Review and Adjust Regularly

Your financial plan isn’t a one-time task. Review it at least every quarter. Check your actual results against your goals and budget. Adjust for changes in client demand, operating costs, or the economy. Staying flexible helps you respond to challenges early and keeps your firm financially strong over time.

Essential Strategies for Long-Term Financial Planning

Long-term financial planning looks beyond day-to-day operations and helps you prepare for what’s ahead in 3, 5, or even 10 years. Here is how you can manage it:

1. Separate Short-Term and Long-Term Needs

Short-term planning covers monthly income and expenses like payroll, rent, and software subscriptions. Long-term planning includes anything beyond 12 months, such as loan repayment schedules, hiring plans, office expansion, or retirement contributions. Clear separation ensures that short-term operations don’t interfere with long-term goals.

2. Project Future Revenue and Costs

Use historical data from past financial years to identify trends in earnings, client growth, or seasonal fluctuations. Forecast revenue realistically based on expected caseload, billing rates, and market demand. Estimate long-term costs such as lease renewals, staff expansion, tech upgrades, or insurance premiums. Include inflation and cost increases in projections to keep your estimates grounded.

3. Plan for Debt Management

List all current debts, including loans, lines of credit, and equipment financing. Create a repayment plan aligned with your projected cash flow. Avoid stacking short-term liabilities that can disrupt long-term cash reserves. Refinance if needed to get better terms that support your long-term strategy.

4. Align Investments with Firm Goals

Invest in growth areas like digital tools, marketing, or niche practice development. Evaluate ROI before making significant financial commitments. Prioritize stability; don’t overextend your finances in pursuit of fast expansion. Balance reinvestment and savings to ensure you have enough reserves while funding future growth.

5. Build an Emergency and Opportunity Fund

Maintain at least 3–6 months of operating expenses in a separate account. Use this fund for emergencies like sudden revenue loss, equipment failure, or legal disputes. You can also use it for opportunities, like hiring a skilled attorney or launching a new service- without disrupting operations.

6. Plan for Retirement or Exit

Start early with retirement planning—even if you’re not planning to exit soon. Set up retirement contributions like a SEP IRA, Solo 401(k), or defined benefit plan. If you own a firm, consider succession. Decide whether to sell, transfer, or wind down operations. Have a transition plan to ensure continuity for your clients and team.

Best Practices For Saving and Investing for a More Secure Financial Future

Here’s how to stay financially secure with smart saving and investment strategies for individual lawyers and law firms.

For Individual Lawyers

1. Build a Personal Emergency Fund

Start with a savings buffer that covers at least 3 to 6 months of personal living expenses. This gives you financial stability in unexpected events—such as client loss, a slow season, or health issues. Keep this money in a high-yield savings account or money market fund for easy access.

2. Diversify Your Investments

Avoid putting all your money back into your practice. Diversify your portfolio across different asset types:

- Mutual funds

- Index funds

- Bonds

- Real estate

- ETFs (Exchange-Traded Funds)

Diversification reduces risk and helps your money grow steadily over time. Reassess your portfolio annually to stay aligned with your goals.

4. Set Clear Personal Financial Goals

Define what you’re saving and investing for: retirement, buying property, your child’s education, or travel. Set timelines and contribution plans for each. This will help you stay committed and manage your resources better.

For Law Firms

1. Maintain an Operating Reserve

Your firm should maintain savings covering 3–6 months of core operating costs. This reserve protects your practice from disruptions caused by late payments, lost clients, or slow months. Keep these funds separate from your daily operating account and only use them in emergencies.

2. Invest in Practice Growth

Use part of your firm’s retained earnings to invest in:

- Marketing and client acquisition tools

- Legal technology (case management software, billing systems, AI tools)

- Training and development for your team

- Expanding practice areas or geographic reach

Track the return on each investment to ensure you’re allocating capital effectively.

3. Consider Passive Income Streams

Law firms can also build passive revenue through:

- Offering subscription-based legal services

- Creating online legal resources or toolkits

- Partnering with legal tech startups or platforms

These income sources can reduce dependency on billable hours and add financial flexibility.

4. Plan for Capital Investments

Create a multi-year investment plan for more significant, long-term upgrades, like opening a second office, purchasing commercial property, or implementing new infrastructure. This plan should include cost estimates, funding sources (savings vs. financing), and expected return.

5. Review Investment Options for Firm Funds

Larger firms with stable cash flow can explore low-risk investment vehicles to grow unused capital. Options include:

- Money market funds

- Corporate bond funds

- Short-term CDs (Certificates of Deposit)

Always consult with a financial advisor to ensure compliance and risk alignment.

Travel the World While Advancing Your Legal Career With Destination CLEs

Destination CLEs redefine the way legal professionals meet their continuing education requirements. Our conferences blend educational opportunities with cultural immersion in some of the world’s most captivating cities.

Why Choose Destination CLEs?

- Meet CLE Requirements: Fulfill your mandatory CLE credits through engaging, high-quality seminars in stunning global locations.

- Transformative Learning: This approach turns lecture-based learning upside down by engaging in sessions as dynamic as the destinations.

- Networking Opportunities: Connect with peers worldwide, expanding your professional network in settings that encourage collaboration and growth.

- All-Inclusive Experience: Enjoy comprehensive packages that cover educational sessions, accommodations, and unique cultural experiences, making your learning adventure seamless and memorable.

- Efficient Credit Earning: Earn required CLE credits efficiently, with schedules that balance professional development and exploration.

Plan your next educational journey with Destination CLEs and ensure extraordinary professional development. Our 2024-2025 lineup includes diverse locales such as Dublin, Ireland; the Mediterranean Sea Cruise; Dubrovnik, Croatia, and Athens, Greece—each offering a distinct blend of legal education and local culture.

Secure your spot today and become part of a community dedicated to professional growth and networking.

Recent Legal Tips & Travel Insights

Financial Planning for Lawyers and Law Firms: Secure Your Legal Practice

Why Attorneys Are Choosing Destination CLEs for Their Continuing Legal Education?

Social Media for Lawyers and Law Firms: 2025 Guide

7 Essential Tips to Improve Client Relationships in Your Law Firm

Best European Cities to Combine Work and Leisure While Attending a CLE

How to Overcome the Challenges of Managing a Virtual Law Firm?

The Complete Guide to Solo Travel for Lawyers: Tips, Tricks, and Essentials

Cybersecurity for Law Firms: How to Protect Client Data

CLE on a Cruise: Why It’s the Best Way to Earn Credits While Traveling

Weekend Getaways: How to Extend Your CLE Conference into a Vacation

How CLE Requirements Differ Across U.S. Jurisdictions for Lawyers?